1031 exchange steps requirements guidelines gain capital types 1031 exchange tax report do return tip sheet 1031 exchange calculator with answers to 16 faqs!

Irs 1031 Exchange Form - Form : Resume Examples #EpDLaMr5xR

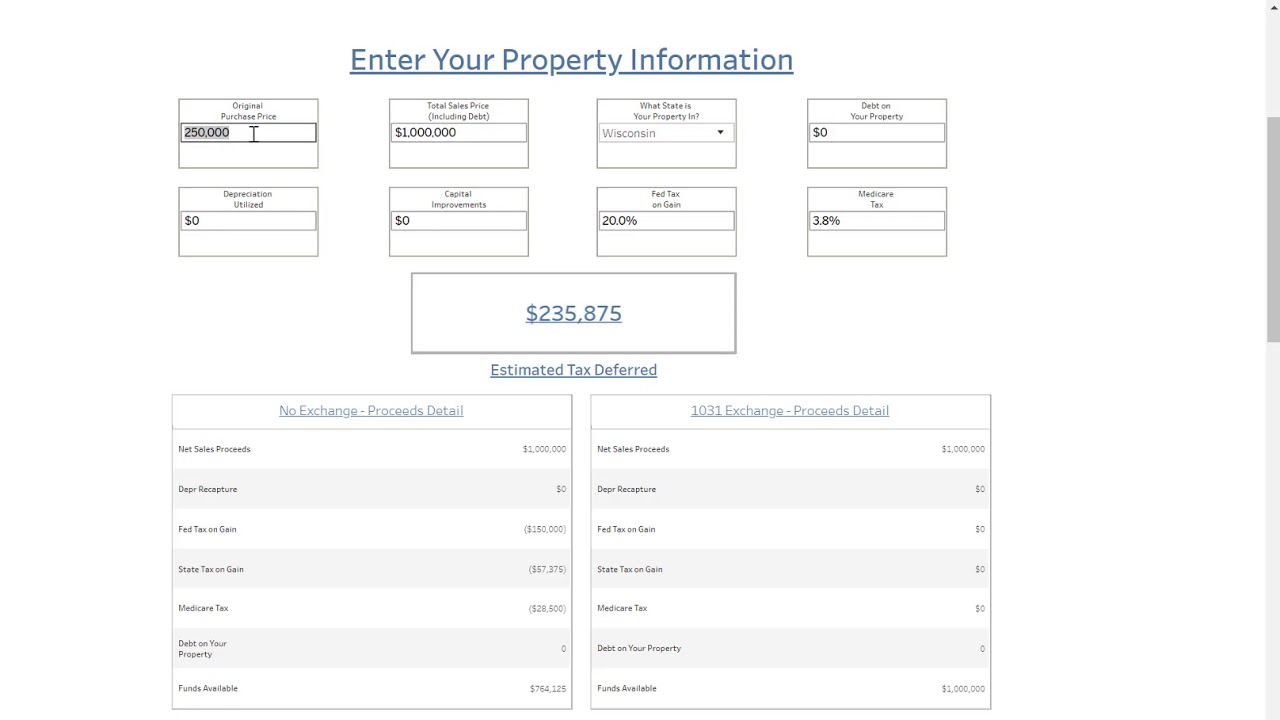

The clear & complete guide to the 1031 tax deferred exchange 1031 exchange spreadsheet section next profits move property looks into 1031 exchange calculator

1031 exchange hypothetical transaction purposes actual vary example results only may property

How do you report a 1031 exchange on tax returnPartial 1031 exchange [explained a-to-z] propertycashin 1031 exchange 1033 basis property calculate kind gain loss boot cost following received exercise answered hasn expert ask question yet1031 exchanges in iowa.

Exchange 1031 worksheet kind consider deferred spreadsheet tax clients learn should why comparison assumptions ones shaded entries simply shown yellowFree spreadsheet to learn why your clients should consider a tax 1031 exchange transaction hypothetical1031 exchange calculation worksheet.

Exchange worksheet kind 1031 1040 completing business property tax accountants save excel db

1031 exchange agreement template1031 and 1033 exercise in the following 1031 Calculator exchange 1031Irs 1031 exchange worksheet.

Depreciation recapture 1031 1250 gain recaptured portion1031 exchange and depreciation recapture explained a-to-z What is a 1031 exchange?1031 agreement exchanges.

1031 irs deferred owners calculation taxes describes revenue

1031 exchange stepsIrs 1031 exchange form .

.

![Partial 1031 Exchange [Explained A-to-Z] PropertyCashin](https://i2.wp.com/propertycashin.com/wp-content/uploads/2020/11/Partial-1031-Exchange-Explained.png)

Partial 1031 Exchange [Explained A-to-Z] PropertyCashin

Free Spreadsheet to Learn Why Your Clients Should Consider a Tax

1031 Exchange | Is a 1031 Exchange Right for You? | Defer Property Tax

1031 Exchange and Depreciation Recapture Explained A-to-Z | PropertyCashin

1031 Exchange Steps

1031 Exchange Agreement Template | HQ Printable Documents

Irs 1031 Exchange Form - Form : Resume Examples #EpDLaMr5xR

Irs 1031 Exchange Worksheet | TUTORE.ORG - Master of Documents

1031 Exchange Calculation Worksheet - Ivuyteq